In the last two years, Indian stock markets have galloped ahead, infact much ahead than those in the West. Only a handful of emerging markets outpeformed India in these two years. However, performance of Indian markets has been rather muted since the beginning of 2006. Infact, it has been one of the only two emerging markets to have recorded a decline, the other being Sri Lanka.

click here to see the MSCI indices for developed and emerging marketsAt a

P/E ratio of 18 times, current valuations aren't too cheap either.

click to read what funds are sayingSo what does one do as an investor. My idea is to remain invested in the stock markets. Rising investments (both by the corporate sector and the public sector companies) , rising salaries, flow of portfolio money from international investors, healthy GDP growth (even though it is showing signs of a slow down, with lower IIP growth in recent months), are some of the few reasons to remain invested in equities in India. Besides, today there aren't too many countries that are growing at our pace. With the little reading that I've done in recent times, Brazil and Russia seem to be more attractive than India (purely on a valuation basis). On the east, Japan seems to be waking up to the world of portfolio investments after ages.

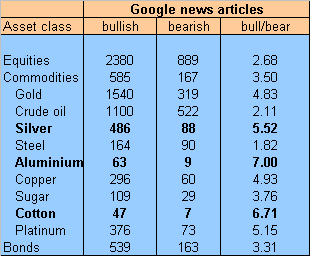

But, all in all India seems to be the place to stay invested in 2006. A search of news.google.com suggested the same.

click here to see the results of the searchNow, the question is when and in what companies ?

Q1. When ?

Ans - After the Union Budget. Buying before the UB has been one of the worst investment ideas in recent times. More often that not investors have lost money while investing in the so-called "Pre-Budget" rally. The concept of such a rally is really misleading, as expectations (rational or otherwise) are built-in stock prices most of the times. Obviously, all of them cannot be met and are never met. End result- a post UB fall in stock prices. I am not suggesting that this will be the case this year too. But, if the p(getting a stock 15-20% cheaper) > 50%, why not wait.

Q2. Where to invest ?

Ans - Nifty and Nifty Junior companies should be forgotten by now, with an odd exception of oil and a few power companies and yes, MTNL. Most of the stocks in the Nifty and the NJ are trading at high P/E ratios. They are insane in cases of HLL, ITC, IT stocks, and construction stocks like L&T. Not much room to go up there. It is markets like these that are difficult to make money in, investing in 2004 and 2005 was as easy as solving a simple algebra equation (2+2=4). And I am not joking here. If someone wants to try, just randomly pick 20 stocks from BSE and see the returns on these stocks (clubbed as a portfolio) over the last 2-3 years, the result that is most likely will be an outperformance of the benchmark indices, BSE Sensex and NSE Nifty.

So, the real fun begins now. This year will be a stock picker's market. And, being a student of Graham and Buffet, - I have found a few. These are a mix of value stocks (

cigar butts, as dear Mr. Munger would've called them) and a few growth stocks.

They are -

Growth stocks -

Man Industries and PSL - Both these companies are in the business of making SAW (submerged arc-welded) pipes). With new investments in the crude oil exploration and transporation taking place, not just in India but across the globe, these companies will do very well in the coming 4-5 quarters.

Twenty First Century Printers - A small packaging company that caters to all the top names in the domestic FMCG industry. Concluded capacity expansion plans in Nov'05. Expected to record robust y-o-y growth in the coming quarters.

Value stocks -

Tinplate Company of India - Annual cash profit Rs.70 crore plus, current mcap - Rs.240 crore. The co. has turned around in the last one year. Trading at a modest p/e ratio of around 5-6 times.

Subros - Manufactures and supplies air conditioning systems to big car manufacturers in India (Maruti and Telco). Is a market leader. Currently undertaking expansion plans. Modest p/e - 8-9 times, mcap - Rs.200 odd crore, annual sales > Rs.500 crore. Healthy dividend payout.

MIRC Electronics - Owner of the famous "Onida" brand of TV. Trading at a p/e ratio of a mere 7-8 times. Small amounts of debt. The consumer durable industry expected to do well, on the back of rising income levels (both in rural markets and urban towns).

Please note these are investments that I have made for myself and they are not intended as an advice. Although, the title of the blog says - "Graham to Livermore, I want to be all", I am still light years away from becoming like either of the two.

~

Happy investing/stock picking 2006.